Renting vs. Buying

Renting vs. Buying: An Educated Perspective on Real Estate OptionsIn today's ever-changing real estate landscape, it can be challenging to determine whether renting or buying a property is the right choice for you. Both options come with their own set of advantages and drawbacks, so it's crucial to

Read More

Following the Interest Rate

Interest rates play a crucial role in the real estate market. They have the power to influence mortgage rates, market conditions, and overall real estate activity. As a potential homebuyer, homeowner, or real estate investor, it is essential to stay informed about interest rates and their impact on

Read More

Real Estate Market Report - Woodridge, IL (Nov, 2023)

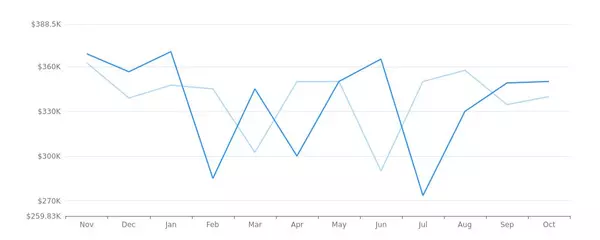

Current Market Condition 21 Active Listings 6 Pending Listings $339,000 Median List Price View Properties for Sale Find Out Your Home Value The median sale/list price data shows a fluctuation in prices from November 2022 to October 2023, with the highest median price in January 2023 at $370,000 and

Read More